Driving the Digital Agenda in the Insurance Industry

Covid 19 has accelerated the need for the Insurance Industry to transform digitally. This is necessitated by the need to cull the avoidable document volume, put the customer in control through a better digital experience, to reduce cost and digitise sales.

As documents continue to overwhelm the insurance industry, so do technical solutions designed to help. Insurance is about information and much of that information leaves and lives in the insurance lifecycle as printed or emailed documents. These documents are complex and given the regulation and compliance requirements the need for compliant accuracy is paramount. An added complexity is that much of the content required to complete these documents lives on multiple legacy systems. This raises the probability of errors occurring when populating the policy for example.

As documents continue to overwhelm the insurance industry, so do technical solutions designed to help. Insurance is about information and much of that information leaves and lives in the insurance lifecycle as printed or emailed documents. These documents are complex and given the regulation and compliance requirements the need for compliant accuracy is paramount. An added complexity is that much of the content required to complete these documents lives on multiple legacy systems. This raises the probability of errors occurring when populating the policy for example.

Competition

The drivers of competition in Insurance are no longer price or scope but now are focused on convenience for the customer. Manual creation of personalized communication is not only prone to error but is also very costly. The same is true of custom written systems maintained inhouse.

Compliance

In a highly regulated market, the Insurance industry needs policies and all documents free of errors, complying with law and internal policies. This needs to be delivered in a super personalized way with the highest quality levels. For example, claims process needs to trigger automatic acknowledgement and constant communication with customers throughout the claims process.

Complexity

Policies, proposals, claims, contracts, correspondence, and marketing are some of the many documents that need to be accurate, personalized, professional, and compliant. The idea of collating, emailing, printing, completing, scanning, emailing back, indexing and storage is as antiquated as landline telephones. Insurance companies use anywhere between 200 and 500 document templates across their product sets.

According to Forrester over 70% of business processes are paper and email based which is astonishing given that most Insurance companies are over 5 years down the line with their digital journey.

Research also tells us that over 30% of knowledge workers’ time in the Insurance Industry is spent locating and updating templates. The existing storage systems can range from multiple Document Management Systems to multiple employees’ hard drives.

Bringing new products to market takes months as opposed to weeks because of flthe complexity of documentation that needs to be compiled, which influences the time to market. This of course leads to not only lost revenue and market share, but also customer churn.

Customer satisfaction in many cases is at an all time low and as a result the company’s reputation suffers. Higher costs and lower employee satisfaction are also some of the resulting issues.

To add to the above, broker services are also severely affected, and field staff have an inability to autogenerate documents. Adding the reinsurers just adds more complexity to the chaos.

Covid-19 has changed our lives forever. Many companies are implementing indefinite work from home policies. Non face-to-face dealings requires the development of digital personalities of which digital professionalism is a prerequisite. Digital personalities are often developed on Social Media, but the operational delivery is digital.

Legacy systems such as SAP, Oracle, Sapiens and TIA, for example, were supposed to deliver on this digital promise. These systems while great at optimizing internal company processes are sadly lacking when dealing with non- standard processes and processes which cross organizational boundaries to Customers, Brokers and Reinsurers.

There are systems that claim a lot of functionality on the market and as with anything there are horses for courses but when looking for products one must be clear on the exact requirements. The need is for document generation and automation which is industrial grade and can link to the other pillars of digital transformation.

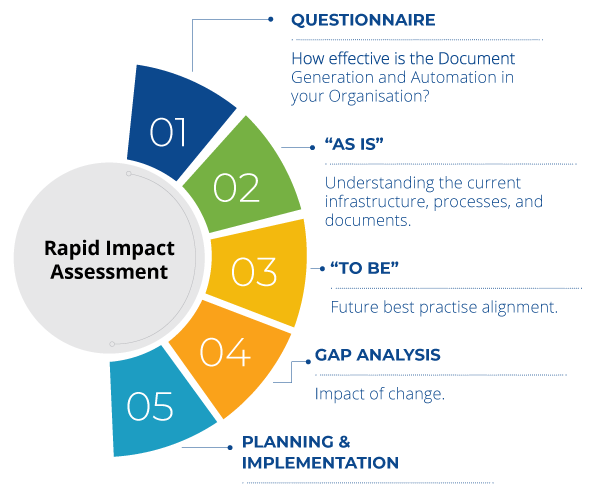

Make Insurance simple with DocFusion. Delight your customers by making, doing business easier. The Insurance Industry is dependent on documents. Use DocFusion to digitise and orchestrate their flow across and external to your organisation. DocFusion will allow you to leapfrog in your digital journey without the need to rip and replace your legacy systems. The ease of use, plethora of functionality, the benefits case and ease of implementation makes DocFusion an easy decision.